Self-driving cars will do so much more than drive

Cars in the next few years will be able to find the fastest route for the morning commute as well as order coffee, pay for it and guide the driver to pick it up.

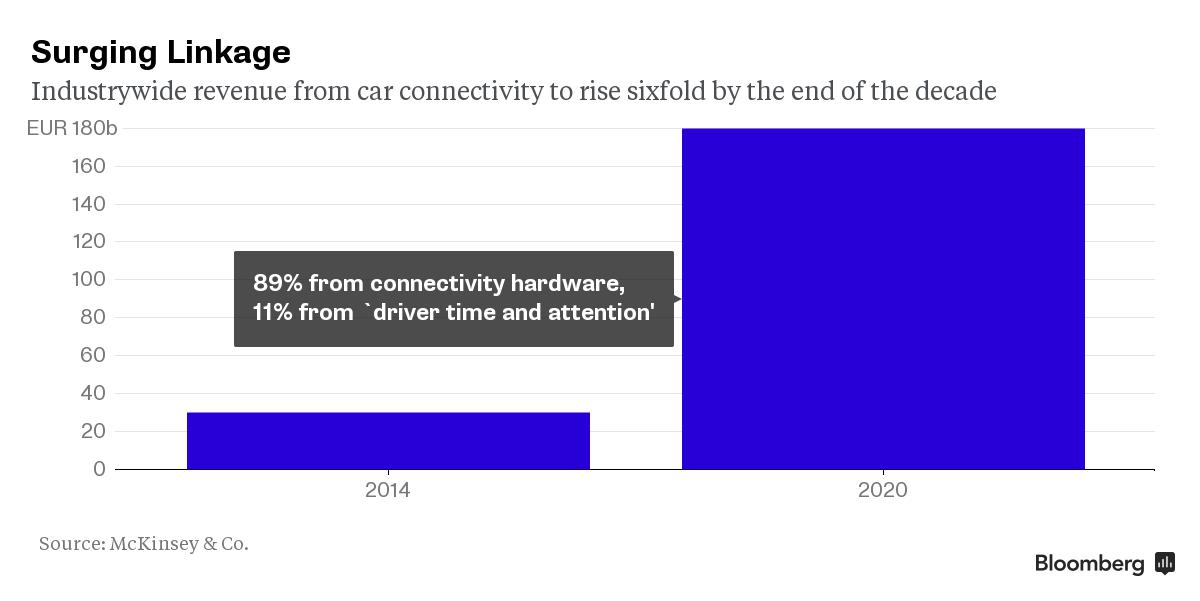

This transformation of the auto into a full-service mobile device adds up to a potential goldmine. Revenue from the data streams and connectivity components could become a 180 billion-euro ($200 billion) market by 2020, McKinsey & Co. estimates. That’s a rich target for Apple Inc. and Google Inc., and automakers are fighting for a claim as well.

Instead of just producing transport hardware, “we have to get into the service industry in a larger way,” Tony Douglas, BMW AG’s mobility services unit, said to a roomful of executives at a recent conference in Munich.

“The transportation industry is ripe for disruption. Either we kind of drive that disruption and gain from the new business models that will emerge, or we let someone else do it.”

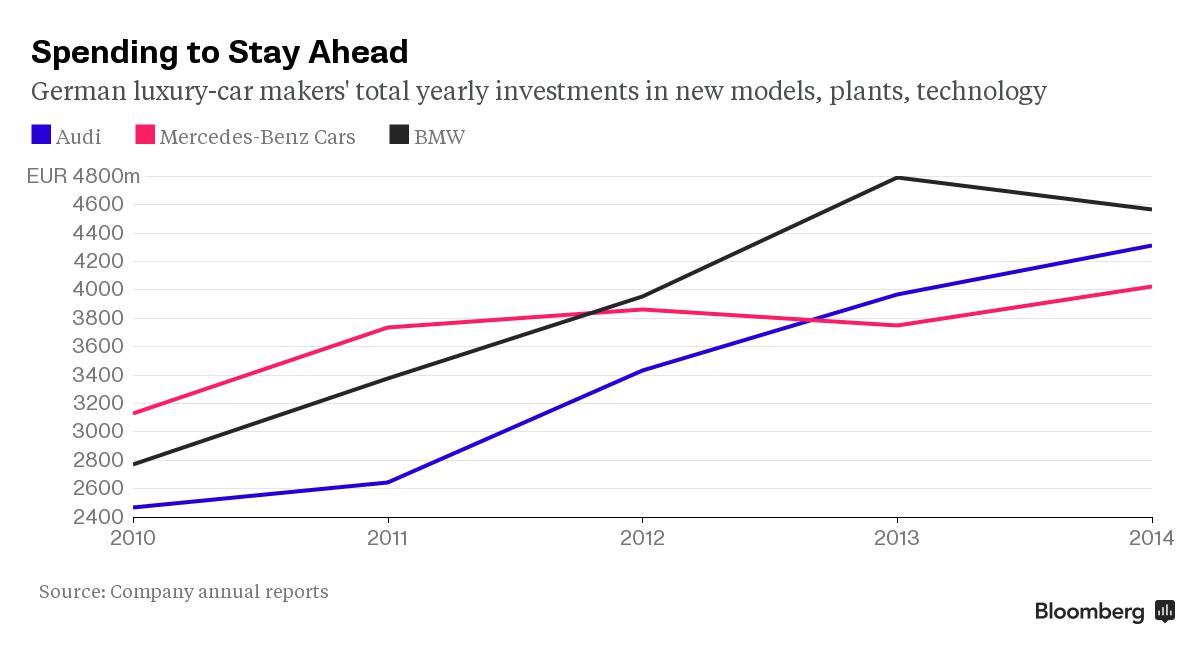

BMW, Volkswagen AG’s Audi and Daimler AG’s Mercedes-Benz compete head-to-head on everything from new models to passenger comforts. But the threat of an Apple car has helped prod them to make a joint bid to acquire Nokia Oyj’s HERE digital map business, which may fetch as much as $4 billion, people familiar with the matter have said.

Fine-grained location data is considered crucial to set up new services – like a coffee-buying car – and eventually guide automated vehicles. Owning HERE would ensure the German automakers have an alternative to Google. Relying on the search company’s maps could mean giving up key customer information.

10,000 E-Mails

“We want to produce good, safe, beautiful cars, and to that end, we need data,” Christine Hohmann-Dennhardt, the Daimler executive in charge of legal issues, said at a June press event in Munich.

The German automakers’ interest in HERE is part of preparations for a digital-car age. By 2020, about 90 percent of new vehicles in western Europe will be connected, compared with roughly one-third next year, according to Hitachi Ltd. Autos that link to the Internet as well as people’s smartphones generate data equivalent to 10,000 e-mails every hour.

Coupled with predictive software and mobile-payment systems, the information on people’s whereabouts and tendencies can be a valuable resource.

If a driver gets hungry and McDonald’s Corp. can track that and respond, “people would be directed to McDonald’s instead of another fast-food restaurant,” said Peter Fuss, a partner at consulting company EY’s German unit. The systems to tap these capabilities could start emerging in the next two to three years, he said.

On-Road Internet

Car data could also be crucial for making roads safer. If wheels spin on an icy patch, the vehicle could automatically relay that information to others on that stretch.

Ultimately, the goal is to enable people to take their hands off the wheel as the car drives itself. McKinsey estimates automated vehicles could free up as much as 50 minutes a day for users globally. This could generate digital-media revenue of 5 billion euros a year for every minute drivers spend with their eyes on the Internet instead of the road, the consulting company said in a June study.

If they can avoid the fate of being marginalized by Apple and Google, automakers could reap about $400 a car in extra revenue and savings on development spending, according to Roland Berger Strategy Consultants. In any case, the risk of not offering digital services is even greater.

“Customers won’t be that keen on having big motors anymore,” said EY’s Fuss. “They’ll be more interested in how they can use their time while they’re in the car.”

No comments:

Post a Comment