Greek Prime Minister Alexis Tsipras signaled he’s ready to end his standoff with creditors as the country gets a taste of financial meltdown.

German Chancellor Angela Merkel, Europe’s dominant leader, refused to engage until after a July 5 referendum called by Tsipras on budget cuts demanded by creditors.

It took a third day of capital controls, rationing pensions and the expiry of Greece’s bailout for the government in Athens to say it’s willing to accept his adversaries’ latest offer as a basis for compromise. The looming vote was the major stumbling block, along with disagreements over pensions, spending and taxes.

“This is not quite the climbdown it seems,” said Peter Chatwell, a strategist at Mizuho International Plc in London. “I strongly doubt Europe will accept this proposal and if Europe sticks to its guns and waits for the referendum, the greater the chance that the government fails.”

Merkel and her finance minister, Wolfgang Schaeuble, burned by five months of brinkmanship, said there would be no immediate talks.

Merkel Refusal

“There can be no negotiations for a new credit program before the referendum,” the chancellor told lawmakers in a speech opening a parliamentary debate on Greece. The country has provided “no basis for talking about any serious measures” to break the deadlock, Schaeuble told reporters.

Talks broke down at the weekend with Tsipras taking European leaders and his own country by surprise and declaring he would hold a public vote. As the politics and posturing continued, the difference now is that Greeks are divided between defiance and desperation as cash machines run dry and the economy begins to buckle.

“The clock cannot be simply set back to where it was Friday night before Tsipras broke off the talks and called the referendum,” Holger Schmieding, an analyst at Berenberg Bank, wrote to clients. “A deal is still possible, but it would require more than just this letter.”

Tsipras Letter

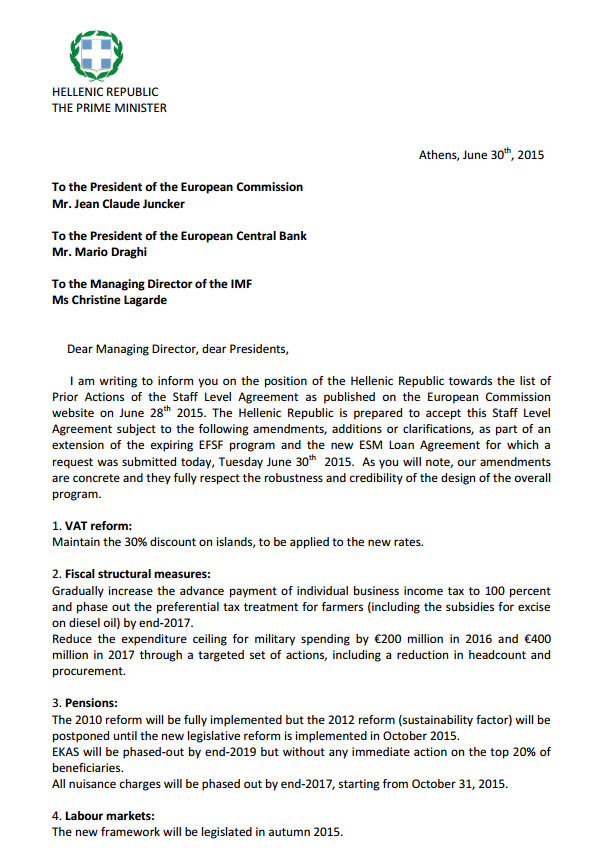

In the letter to European Commission President Jean Claude Juncker, European Central Bank President Mario Draghi and International Monetary Fund Managing Director Christine Lagarde, Tsipras resisted their demands on pensions and tax discounts to Greek islands.

He proposed delaying implementation of the zero-deficit clause for the country’s retirement funds and other pension reforms until October instead of July and maintaining a 30 percent discount on sales tax for islands. He also wants to proceed with planned changes to collective-bargaining rules that the creditors oppose.

They have insisted on pension reforms that would bring savings of as much as 1 percent of gross domestic product by 2016 and immediate steps to eliminate early retirement benefits and allowances for lower pensions.

European stocks and bonds rallied on signs of thawing. The Euro Stoxx 50 index was up 2.3 percent at 12:20 p.m. London time. Yields on debt from Italy, Spain and Portugal all fell by more than 10 basis points.

EU Doubts

The creditor institutions still view the July 5 referendum as a potential barrier to agreement, according to a European Union official. Other officials have said Tsipras needs to call for a “yes” vote or cancel the plebiscite altogether to regain euro-area support.

If Greece votes “yes,” it might be able to win approval for a third bailout package in the next few weeks. If there were a deal in principle, it’s possible Greece could get quick disbursement of 3.3 billion euros ($3.7 billion) from central-bank profits on bond purchases -- money that was set aside for the second bailout and then taken off the table on June 30.

|

Pensioners struggle to get inside a National Bank of Greece branch to collect their pensions in Athens.

If voters say “no,” the pressure on its banking system would ratchet up quickly, leaving Greece little choice but to consider printing its own money. That’s because Greek banks would be unable to meet ECB demands for the collateral needed to keep access to emergency liquidity, and the government would run out of cash to pay its bills and pay its workers.

|

No comments:

Post a Comment