The Adult Diaper Market Is About to Take Off

Sales of adult incontinence garments in the U.S. could equal those of baby diapers in a decade.

Thanks to the endless determination of parents to keep baby bottoms dry, Kimberly-Clark’s Huggies diapers brand has become a global powerhouse, with billions of dollars in annual sales. But the target consumers for one of the company’s latest diaper lines aren’t infants—or even their aged grandparents. Instead, ads for its Depend Silhouette line of disposable incontinence briefs feature laughing, long-legged models who look barely over 40. The personal-care giant has been aggressively running the fashion-style marketing pitches in mainstream magazines and on television, because adult incontinence is a market that’s recently become too big—and lucrative—to remain in the shadows.

“We’re trying to make the product more normal, and even fun, with real people in our ads saying, ‘Hey, I have bladder leakage, and it’s no big deal,’ ” says Jay Gottleib, head of Kimberly-Clark’s adult and feminine-care business in North America.

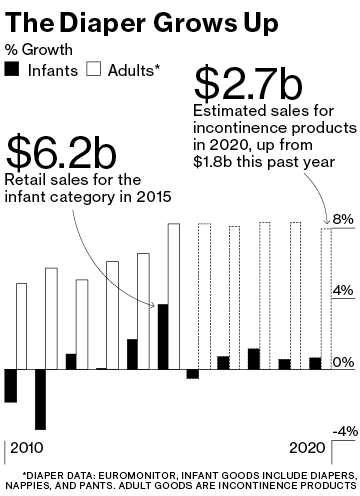

Growth in the adult-diaper market is outpacing that of every other paper-based household staple in the U.S. Euromonitor International forecasts a 48 percent increase in sales in the category, to $2.7 billion in 2020 from $1.8 billion last year. That compares with expected growth of 2.6 percent, to $6.3 billion, during that period for baby diapers. And in only a decade, sales of diapers for adults could surpass those for babies at Kimberly-Clark and rival Procter & Gamble. As birthrates fall and life spans lengthen, the companies figure there’s plenty of room for expansion, because babies grow out of diapers, but incontinent adults usually don’t.

As many as 1 in 3 adults—more than 80 percent of them women—have bladder control issues, the Urology Care Foundation says. Causes include pregnancy and childbirth, health conditions such as diabetes and obesity, and changes that accompany aging, according to the Mayo Clinic.

To tap that market, manufacturers have rolled out marketing campaigns to make a leaky bladder seem if not fashionable, then at least not humiliating. Kimberly-Clark sponsored a free concert in New York featuring the Grammy-nominated indie pop band Capital Cities to promote its adult products. It even produced a rap video featuring Kimberly-Clark employees strutting their stuff around one of the company’s factories while wearing nothing below the waist except its adult briefs. The rap lyrics explain that incontinence hits people of all ages and encourage listeners to “drop their pants for underwareness.” The company also introduced a social media campaign to raise money for an incontinence-awareness charity.

“They’re driving home the point that attractive people in their 40s and 50s or even younger, not just nursing-home residents, can be wearing this under their clothing,” says Marlene Morris Towns, a teaching professor of marketing at Georgetown University.

Incontinence briefs, available in different styles for men and women, look a lot like regular underwear and come in a range of colors. Instead of being stacked on shelves like baby diapers, some of Kimberly-Clark’s latest adult incontinence gear comes in packaging that hangs on hooks in store displays and has transparent windows that show the absorbent disposables folded like cotton underpants. A box of 10 Depend Silhouette Active Fit briefs sells for $11.97, or about $1.20 each, at Walmart.com. A 44-count box of the company’s Huggies Snug & Dry diapers for infants costs $7.97, or about 18¢ each.

When casting the ads for its active-fit Silhouette briefs, the company hired models and brand ambassadors a generation younger than its former white-haired spokeswoman, the late actress June Allyson. Among them: comedian and television star Sheryl Underwood, 52, and slam poet “Mighty” Mike McGee, 40.

Svetlana Uduslivaia, a head of tissue and hygiene research at Euromonitor, says newer goods such as Depend Silhouette and P&G’s Always Discreet are thinner and less discernible under clothing, and in general are designed for more physically active consumers. They “wouldn’t be very suitable for those with more serious forms of adult incontinence usually associated with older seniors,” she says. So the products’ strong sales growth might suggest that younger people are drawn to them. A Kimberly-Clark spokesman says the company doesn’t yet have numbers to show its more youthful push is working. It suggests many younger incontinence sufferers still use products not intended to handle the problem (such as sanitary pads) because of a reluctance to buy goods designed for seniors—a stigma that its media campaign hopes to end.

Kimberly-Clark has more than half the U.S. incontinence-garment business, with 56 percent of sales last year, compared with 9 percent for P&G and 7 percent for Sweden’s Svenska Cellulosa, maker of the Tena brand of incontinence goods, Euromonitor estimates. Unlike Kimberly-Clark, P&G targets only women with one of its product lines—Always Discreet, introduced in 2014. Women already are familiar with the company’s Always brand, which includes such female personal-care products as menstrual pads and liners. “Always Discreet has been very successful in bringing along a lot of the younger women, because it’s a brand that they trust,” says Yuri Hermida, vice president of North American baby and feminine care at P&G.

Hoping to grab an even bigger slice of the incontinence market, Kimberly-Clark last year introduced Poise Impressa bladder supports for women, one of the first incontinence products to be worn internally. It’s designed to help prevent urinary leaks rather than simply absorb them. Inserted into the vagina like a tampon, it lifts and gives support to the nearby urethra, which in turn helps stop urine from leaking out. The target audience includes women who suffer so-called stress urinary incontinence, often triggered by coughing, sneezing, or even dancing. Ads for the product feature a smiling middle-aged woman and a marketing pitch that promises to “let you laugh without leaks.” More than laughter, for Kimberly-Clark the products may bring in serious profits.

The bottom line: Sales of adult incontinence products are forecast to rise 48 percent from 2015 to 2020. Baby diaper sales will grow 2.6 percent.

No comments:

Post a Comment