- Why Bayer's Monsanto Offer Has Investors Concerned

- Unsolicited offer by Bayer on May 10 was for $122 a share

- Bayer proposes to fund part of deal with rights offer

Bayer AG offered $62 billion to buy Monsanto Co., deepening investor concern that it will strain its finances as it seeks to become the world’s biggest seller of seeds and farm chemicals.

The German company on Monday said it had told Monsanto it’s willing to pay $122 a share in cash. Bayer’s stock dropped as much as 6 percent, extending losses since the potential deal was first revealed. Monsanto shares posted muted gains, rising 4.9 percent to $106.45 in New York trading, signaling that investors remain skeptical about the deal.

“I don’t think Monsanto will accept” Bayer’s proposal, said Andrea Williams, a fund manager at Royal London Asset Management Co. “The danger is that you start then having discussions about how you are going to fund a higher offer, because they are already stretching the balance sheet.”

Buying Monsanto would allow Bayer to tap growing demand at a time when farmers must boost productivity to feed an estimated 10 billion people globally by 2050. Bayer Chief Executive Officer Werner Baumann has suggested that notion will convince skeptical investors of the value of the deal -- and help overcome public backlash at home against Monsanto’s genetically modified seeds -- as he seeks to pull off the biggest corporate takeover ever by a German company.

Monsanto Name Hated by Anti-GMO Forces May Vanish in Bayer Deal

The offer, which values Monsanto’s outstanding shares -- without accounting for debt -- at about $53 billion, represents a 37 percent premium to the May 9 closing price. The payment would be funded with a combination of debt and equity, with about $15.5 billion coming from selling shares to existing investors. Bayer doesn’t expect to sell any assets to fund the purchase, Baumann said.

China National Chemical Corp., or ChemChina, earlier this year valued Syngenta AG at more than 16 times earnings before interest, taxes, depreciation and amortization, Susquehanna Financial Group analyst Don Carson said in a note Thursday. A similar multiple means Bayer would need to offer $145 a share for Monsanto, he wrote then.

Monsanto shares are trading about $15 below the offer price, the worst performance on the day of the announcement of a megadeal -- those topping $30 billion -- since Anthem Inc. last July agreed to buy Cigna Corp. for $188 a share, according to data compiled by Bloomberg. Cigna shares closed 22 percent below the offer price on the day the deal was announced.

‘Uneducated Reaction’

Bayer fell 5.6 percent to 84.47 euros, the lowest since October 2013, in Frankfurt. That followed a plunge on Thursday, when it confirmed that it had made an offer, without disclosing the details.

“What we saw last week was an uneducated reaction in the media and the press because we did not communicate the details of our proposal,” Baumann said on a conference call on Monday. “We are utterly convinced of the rationale” of the purchase.

A deal would boost earnings per share by a “mid-single-digit percentage” in the first full year after completion, and by more than 10 percent thereafter, Bayer said. The German company also expects savings of about $1.5 billion annually from the fourth year following the deal.

Monsanto said on Thursday it was consulting financial and legal advisers. In a note to clients, Citigroup Inc. analysts Peter Verdult and Andrew Baum said they “would be surprised if Bayer’s first proposal was accepted outright.”

Abandoning Name

Bayer would likely abandon the Monsanto name after the purchase, just as it has dropped other brands following previous acquisitions, according to a person familiar with the matter. This could help distance the enlarged company from Monsanto’s reputation, the person said.

The offer marks a reversal of roles for Monsanto. The company had sought to buy Syngenta AG, but abandoned its $43.7 billion bid in August after the Swiss pesticide maker refused to agree to a deal.

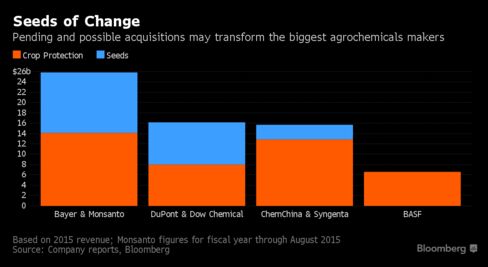

The crop and seed industry is being reshaped by a series of large transactions. ChemChina agreed in February to acquire Syngenta for about $43 billion. Meanwhile DuPont Co. and Dow Chemical Co. plan to merge and then carve out a new crop-science unit.

The kind of genetically modified seeds that Monsanto started to sell two decades ago now account for the majority of corn and soybeans grown in the U.S.

Bank of America Corp. and Credit Suisse Group AG are advising Bayer and helping finance the deal, while Rothschild has also been retained as an adviser.

No comments:

Post a Comment