“They seem to have a finger on the pulse of what the public wants at a level that I haven’t seen.”

When Captain America bursts back onto the big screen on May 6, audiences will likely be thrilled by his much anticipated fight with Iron Man. The outcome of the battle, however, is a foregone conclusion: Walt Disney will emerge victorious. Box-office analysts say Captain America: Civil War—the eighth Marvel film from Disney since it bought the company in 2009 and the third Captain America film—could rival the biggest hits in the franchise. The reviews are overwhelmingly positive, and advanced ticket sales have eclipsed those of other superhero movies, confounding naysayers who were warning that moviegoers might be tiring of the genre.

The likely blockbuster kicks off a potentially record-breaking summer for ticket sales and what analysts say could be Disney’s best year at the movies in its history. Disney, with a 25 percent market share this year, is dominating the film business to an unprecedented degree. In the first half, Disney will have the No. 1 movie for 13 of those 26 weeks, predicts Barton Crockett, an analyst at FBR Capital Markets. “They will have the highest share in a generation, or maybe of all time,” he says.

The studio also is scoring points with a mix of nostalgia flicks such as its Star Wars sequel and technology-driven hits like The Jungle Book, Crockett says. “They seem to have a finger on the pulse of what the public wants at a level that I haven’t seen before.”

Disney’s advantages lie in its storytelling ability and the strength—and number—of its brands. Time Warner’s Warner Bros. has DC Comics, and Comcast’s Universal Pictures has a strong animation arm, but Disney has unparalleled scale. This is largely because of an acquisition spree by Chief Executive Officer Bob Iger, which included Lucasfilm, Marvel, and Pixar. That built the studio into five potent film brands while competitors weren’t investing in the risky business.

Playing catch-up, rival studios are digging into their archives to remake films with new twists, such as Sony Pictures’ all-female Ghostbusters. Or they’re having to find franchise properties, such as Paramount Pictures’ venture with Hasbro to bring to the screen a universe constructed around action figure G.I. Joe. The pressure to compete will probably encourage acquisitions. “Smaller firms with unique content will continue to be takeover targets,” says Christopher Marangi, a portfolio manager at Gabelli Funds, an investor in media stocks. But some analysts worry that industry pressure could lead to expensive acquisitions that destroy value as movie companies chase—and overpay for—targets like Lions Gate Entertainment, creator of Twilight and The Hunger Games.

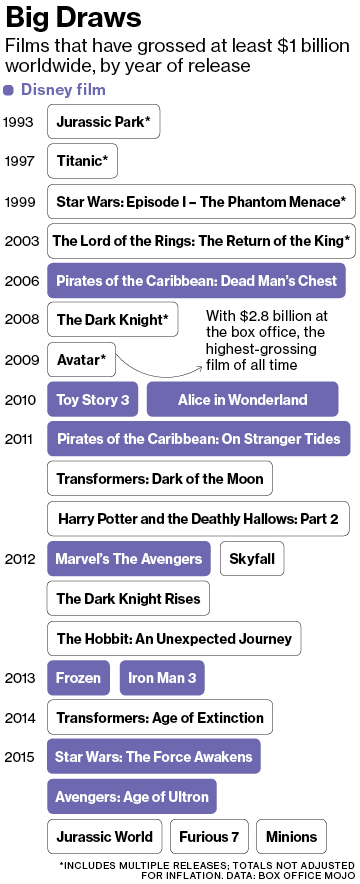

Disney’s multibillion-dollar investment in production companies since 2006 has come to fruition in 2016. The five film units could this year release a record number of movies that break $1 billion in ticket sales. “We have talked for 25 years about the big six global entertainment companies, [but] maybe we are starting to see the stratification among them,” says Jonathan Kuntz, a film historian and professor at the UCLA School of Theater, Film & Television. “ ‘Supermajors’ might be a good term for what Disney, and maybe Comcast and Time Warner, aspire to be.”

For much of the 20th century, Disney, Paramount, Sony Pictures, Warner Bros., Universal Pictures, and 20th Century Fox dominated film production and distribution globally. But Disney’s three acquisitions, along with its two other labels, Walt Disney Animation and Walt Disney Pictures, has left it with some of the best franchises in Hollywood. That’s allowed the studio to map out a combined film slate into 2020.

“That is the future for the next decade,” with Disney and Warner Bros. having laid out superhero movies and other sequels, spinoffs, and reboots for years to come, says Jeff Bock, a box-office analyst at Exhibitor Relations. Bock figures that Disney alone will have six or seven of the top 10 grossing films this year and potentially four movies each generating $1 billion worldwide: Captain America: Civil War; The Jungle Book; Rogue One: A Star Wars Story; and Finding Dory, a sequel to Finding Nemo.

“The Pixar acquisition saved Disney Animation,” says Bank of America Merrill Lynch analyst Jessica Reif Cohen. “That was the beginning.” Disney is “the only company right now that has a branded film strategy,” she says, with each of its sub-brands churning out its own string of reliable, predictable fare. “Consumers know what they are going to get, which makes marketing easy and efficient.”

John Lasseter, one of the original Pixar animators and director of the megahit Toy Story, is the creative leader of Pixar and Walt Disney Animation. That’s allowed him to help reinvigorate the animation unit and produce more modern hits, such as Frozen and this year’s Zootopia.

Universal is aping that approach with Chris Meledandri, creator of the hugely successful Despicable Me films, who will oversee his Illumination Entertainment, Universal’s animation partner, and the DreamWorks Animation studio Comcast agreed to acquire in April. The buyout is seen as Comcast’s attempt to lock in intellectual property—including the characters from DreamWorks’ Shrek and Kung Fu Panda—that Universal can exploit in its theme parks, the way Disney does. “The industry looks at Disney with envy,” Reif Cohen says. “It is a highly successful and unique strategy, well-executed and hard to duplicate.”

Summer is the most lucrative time of year for studios, and analysts predict this season could beat 2013’s record. A slew of highly anticipated releases including Finding Dory and Warner Bros.’ Suicide Squad could, along with Captain America, push the summer season to about $5 billion in ticket sales in North America, estimates Geetha Ranganathan, an analyst at Bloomberg Intelligence.

With breakout hits such as Fox’s offbeat antihero Deadpool and the unexpectedly strong turnout for Disney’s The Jungle Book, 2016 could see recently set annual box-office records broken again—especially because Disney’s second Star Wars-related release will hit theaters in December. Crockett estimates 2016 will outstrip the $11.1 billion annual record generated at the domestic box office in 2015 and Disney’s studios will generate more than $3 billion in profit, its largest ever. For now, at least, Hollywood’s biggest star is Disney itself.

No comments:

Post a Comment